Pre approved mortgage loan bad credit

Bad credit mortgages has been our business since 2003. If you score is below 650 we place your home loan with the best bad credit mortgage.

How Long Does It Take To Get Pre Approved For A Mortgage Credible

ZGMI is a licensed mortgage broker NMLS.

. Youll give us information about yourself. The credit score needed to buy a house depends on the type of loan. After completing a pre-approval you receive a formal document.

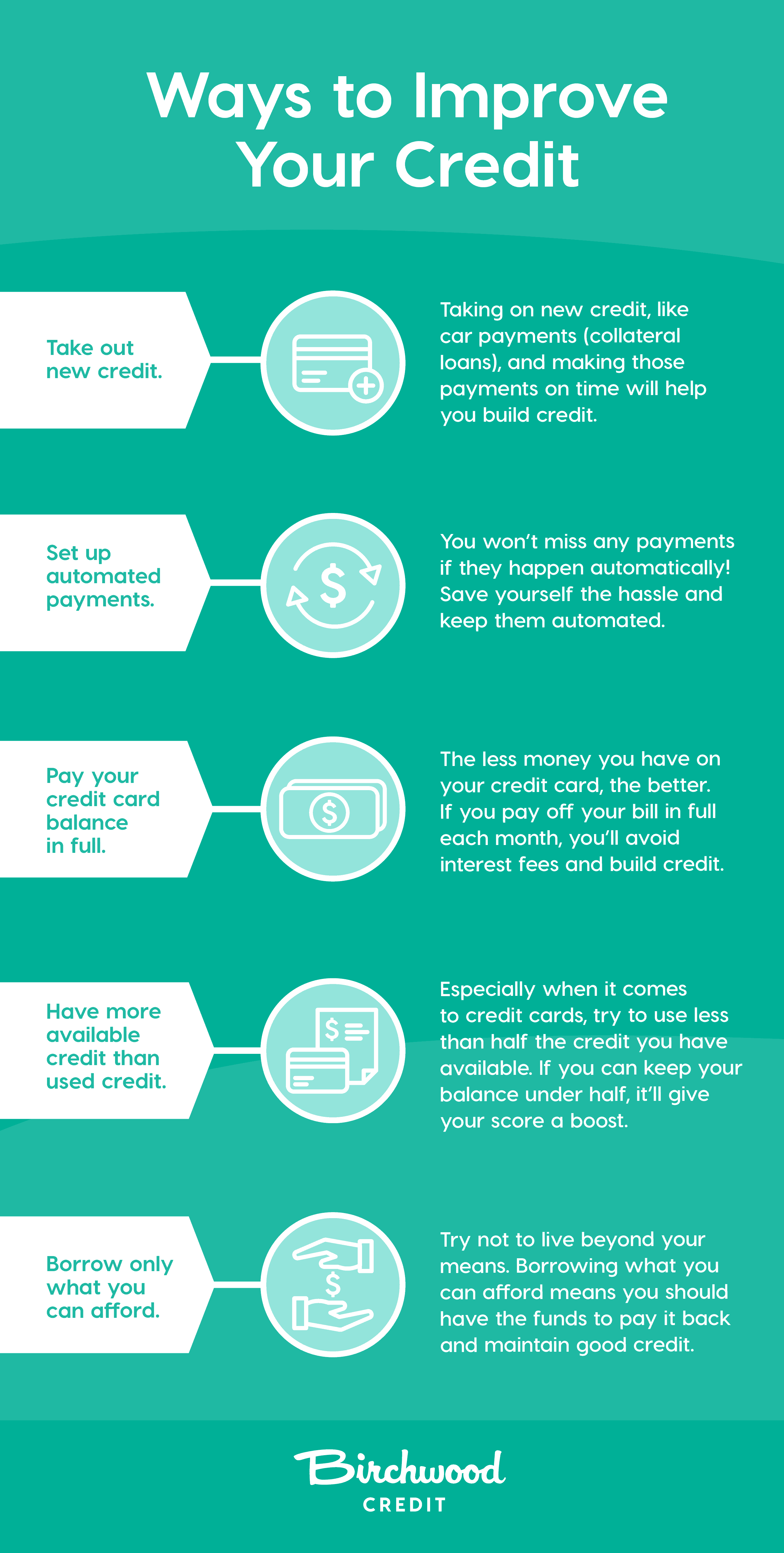

When it comes to buying a home a bad credit score generally falls below 620. But because it is essentially the same as a. Decrease your overall debt and improve your debt-to-income ratio.

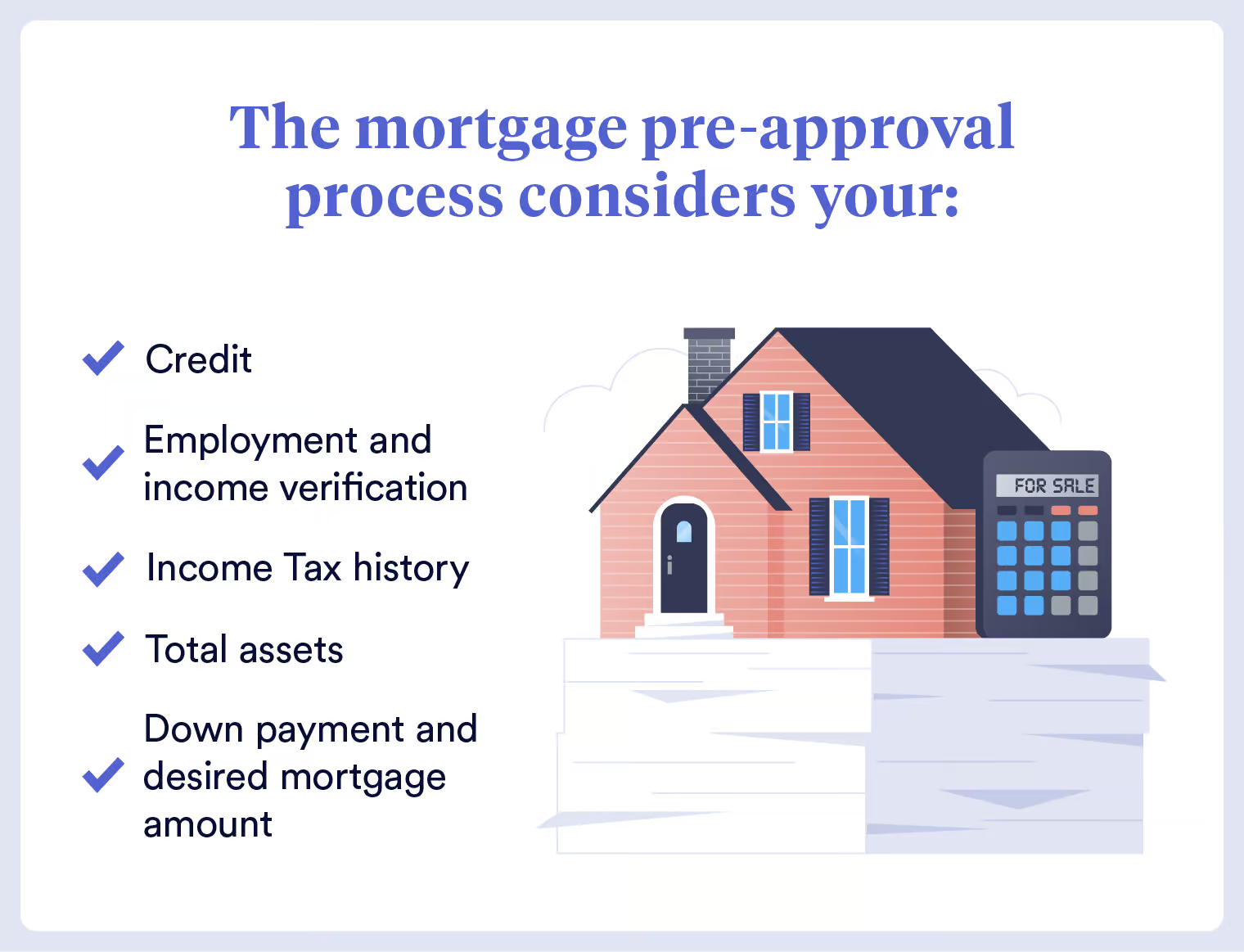

But bad credit could mean not being approved or getting approved for a personal loan with a high interest rate which will cost you more in interest over the life of the loan. To be pre-approved for a mortgage means that a bank or lender has investigated your credit history and determined that you would be a suitable candidate for. Here well list the top 10 online mortgage pre-approval loans for people with bad credit.

If your credit is bad you can expect to pay between 20 and 36 in interest for a personal loan and much more than that for a short-term payday loan. A pre-approval is the process where a lender verifies your information and approves you for a mortgage. TBD Pre-Approval Mortgage Approvals should be a must for borrowers with shaky credit and late payments after bankruptcy andor housing event on manual underwrites.

First mortgages pay for the purchase of a home whereas home equity loans or second mortgages. You can prequalify for a bad credit home loan from Bank of America Mortgage without cost or commitment. Seeking mortgage preapproval before shopping for a home can save time and give you an edge over rival buyers who havent done so.

Providing bad credit mortgages since 2003. Another thing to consider is that pre. A mortgage preapproval is a document a lender produces to tell a home seller how much money you are authorized to borrow to buy a house.

In general a debt. Apply And Check Your Credit. These loans offer competitive rates and easy application processes so you can start.

A Complete Guide to A Home Equity Line of Credit HELOC Home Equity Loan. Loan pre approval is generally a good indicator of future success if you decide to apply for a loan. But you are not guaranteed loan approval.

A Simplified Guide to Borrowing Against Your Home Equity. What It Means. First-Time Homebuyers With Bad Credit Mortgage Loans.

First-time homebuyers with bad credit need to get educated on the types of mortgage loan programs that are. The application process which it calls the Digital Mortgage. Mortgages and home equity loans are available to consumers with bad credit.

Even if you are deemed to have bad credit there are ways to still get pre-approved for a mortgage. Our online application asks you a series of questions to evaluate your eligibility for a home loan.

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

How Can A Bank Deny My Mortgage Application After I Ve Been Approved

How Long Does It Take To Get Pre Approved For A Mortgage Credible

Credit Score Range What Is The Credit Score Range In Canada

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Mortgage Pre Qualification Vs Mortgage Pre Approval The Ultimate Guide

How Many Days Before Closing Do You Get Mortgage Approval Mortgage Broker Store

Mortgage Pre Qualification Vs Mortgage Pre Approval The Ultimate Guide

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Best Bad Credit Loans For September 2022 Nextadvisor With Time

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

How Long Is A Mortgage Pre Approval Good For

Free Financial Family Home Safety Advice For Homeowners

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

12 Bad Credit Loans With Preapproval 2022 Badcredit Org

How Long Is A Mortgage Pre Approval Good For

How To Get Preapproved For A Mortgage Money